Why FWF Market Insights?

Stay up-to-date on industry trends with FWF’s market analysis. The logistics and transportation industry is constantly moving. Understanding the fundamentals of how rates are affected and staying relevant to trends begins with understanding supply and demand. It is vital for your business planning and market knowledge.

If you want to learn more, check out FWF’s Basic Breakdown of Supply and Demand.

Overview

Spot and contract rates continued their year-long uptrend, with incredibly high shipment volume leading the way. The majority of COVID-19 restrictions have been lifted across the U.S., which is positive for the logistics market and economy. However, inflation is high, which is likely to continue rising in the coming months for both producers and consumers. Rates remain high due to the tight capacity of the market.

Truckload Rates

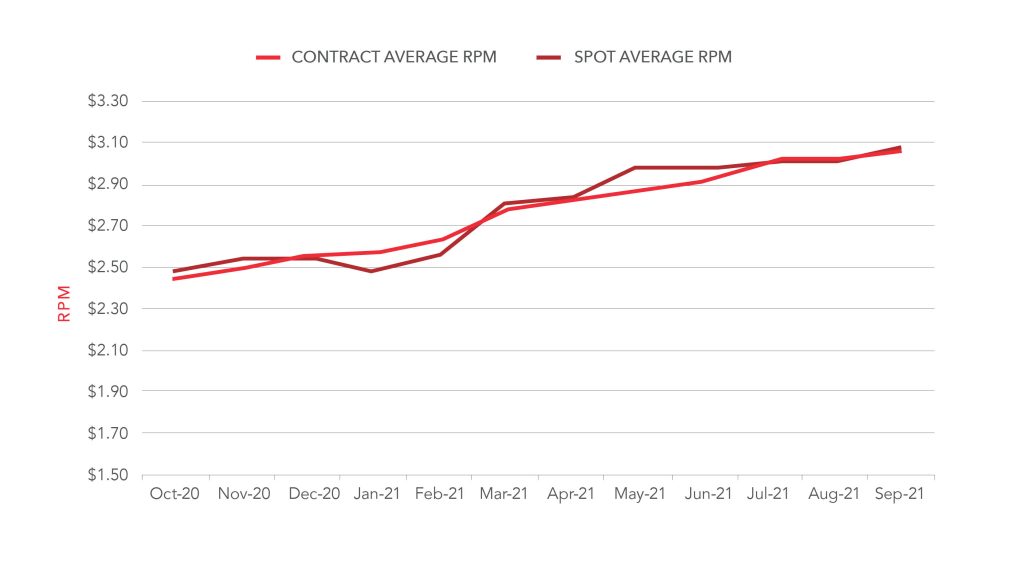

Using spot and contract data from DAT, FWF aggregated the monthly and quarterly rate-per-mile for reefers, flatbeds, and dry vans to determine the average rate-per-mile for the three trailer types combined.

|

Quarterly Contract RPM Including Fuel |

Quarterly Spot RPM Including Fuel |

|||||

| Quarter Average | RPM | % Change | Quarter Average | RPM | % Change | |

| Q3 2020 Average | $2.35 | Q3 2020 Average | $2.31 | |||

| Q4 2020 Average | $2.49 | +5.96% | Q4 2020 Average | $2.52 | +9.09% | |

| Q1 2021 Average | $2.65 | +6.04% | Q1 2021 Average | $2.62 | +3.96% | |

| Q2 2021 Average | $2.86 | +7.92% | Q2 2021 Average | $2.93 | +11.83% | |

| Q3 2021 Average | $3.01 |

+5.24% |

Q3 2021 Average | $3.02 | +3.07% | |

Typically, contract rates lag behind spot rates by a few months. This is because contracts are given at the beginning of each quarter or each year, and as a result, carriers and shippers look to the spot market has to determine fair contract rates.

You can find the most up-to-date RPM data by trailer type on DAT.

Q3 contract rate-per-mile increased by 5.24% from Q2, while Q3 spot rate-per-mile increased by 3.07% from Q2. While there is still a shortage of drivers relative to pre-pandemic levels, the driving factor in the Q3 rate increase shows record shipment volumes, creating higher demand than available capacity. Continued e-commerce demand due to COVID-19 coupled with companies replenishing their inventories as the economy reopened. These driving factors have caused shipment volumes to rise, resulting in ports being congested.

In September, contract rates were up 25.94% Y/Y and spot rates were up 24.36% Y/Y.

In September, contract rates were up 3.02% M/M and spot rates were up 2.07% M/M.

The market stays volatile and unpredictable with rates remaining high. Demand continues to grow through 2021 and into 2022, while supply tries to catch up.

Current Driving Factors Contributing to Demand

1. Rail/Intermodal

While intermodal demand remains high, its volume is slowed due to capacity constraints. As a result of the chassis shortage, domestic intermodal volume is down 11.4% y/y. The volume is expected to continually decline throughout the month of October, the peak intermodal season. Experts estimate the chassis shortage to be a problem for 6 to 12 months.

Along with the chassis shortage, there is a shortage of intermodal containers due to high demand. These intermodal capacity constraints leave trucks to pick up the slack.

2. Inventory Replenishment

When countless businesses shut down last year, total inventory sharply declined between March 2020 through July 2020, putting a halt on shipment volume. After July 2020, a sharp increase in inventory was seen as businesses were able to re-open and companies needed to re-stock to prepare for consumer spending. This strong demand for inventory replenishment created an influx of shipment volume as the U.S. ports were, and still are, flooded with imports.

While a lot of progress has been made, retail sales continue to grow and deplete consumer inventories. Inventory replenishment is still much needed and will continue to grow throughout 2022.

3. Consumer Spending

A sharp decrease in consumer spending followed COVID-19 in April 2020. Since then, recovery has followed and passed pre-pandemic levels, reaching record-highs. Although inventory has experienced continual growth, extraordinarily high demands have made it hard to catch up.

Driving Factors Contributing to Carrier Supply

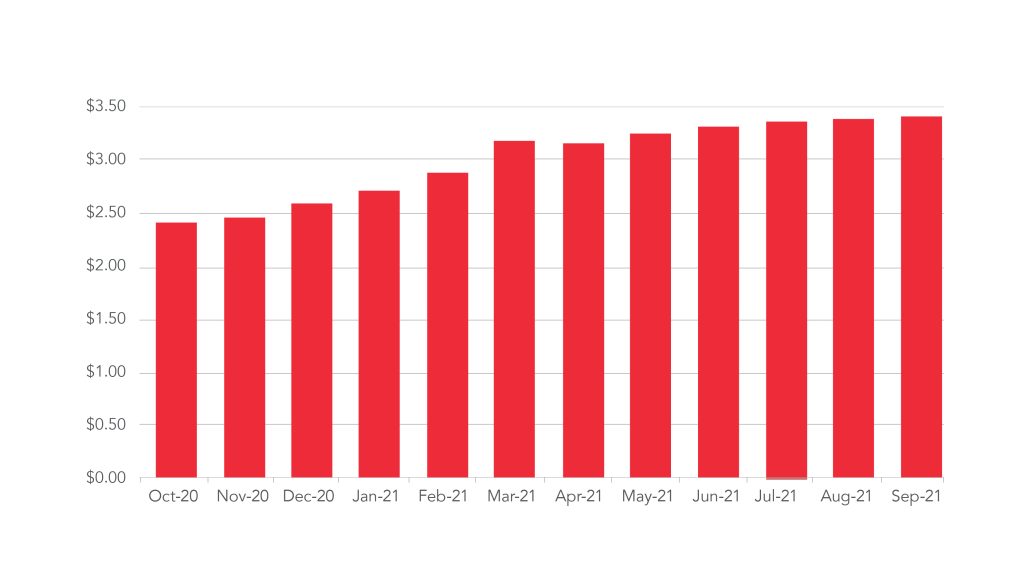

Diesel Prices

Diesel prices are a key factor in determining rates. Diesel prices remain high heading into Q4, contributing to high rates. Higher rates encourage drivers to remain or enter the market. If gas prices rise faster than rates, carriers may suffer profit losses which can drive capacity out of business. Last month diesel prices averaged $3.38 per gallon, up $0.03 from August. Gas prices have been steadily climbing since October 2020 with fuel prices up 40.2% year-over-year in September.

Chip Shortage

There is a semiconductor chip shortage that is expected to continue into 2022. This chip shortage slows the production of new trucks along with several other machines and appliances. While demand for trucks remains high, supply production has not caught up. There are signs that the shortage will ease in Q4, but effects can last through 2023.

The chip shortage is partially due to a lack of labor within the supply chain. The lack of labor is affecting all industries and it is possible that employees will not return to pre-pandemic levels until 2024.

General Supply and Demand Indicators

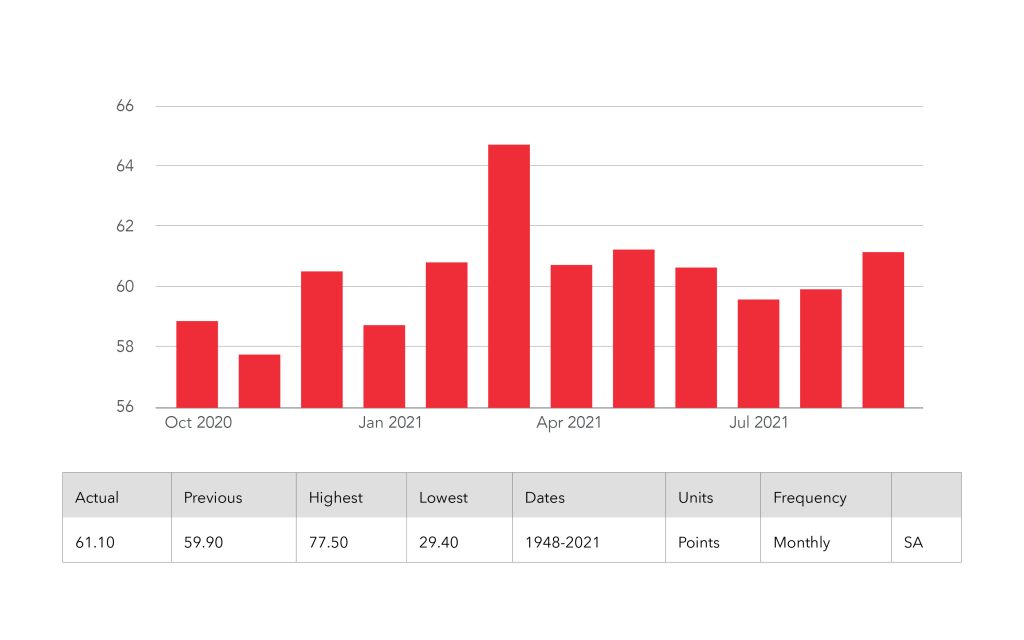

ISM Purchasing Manager’s Index

The Purchasing Manager’s Index (PMI) is a measure of the direction of economic trends in manufacturing. Covering 19 industries, including both upstream and downstream activity, this is a leading indicator of overall economic activity. In the United States, a PMI reading over 50 means the manufacturing economy is expanding, while a reading under 50 means this industry is contracting. When the PMI indicates an expansionary manufacturing economy, volume increases due to increased output.

Currently, the PMI reads 61.1, indicating an expanding manufacturing economy and suggesting a continued increase in shipment volume. PMI has been on a steady increase since July.

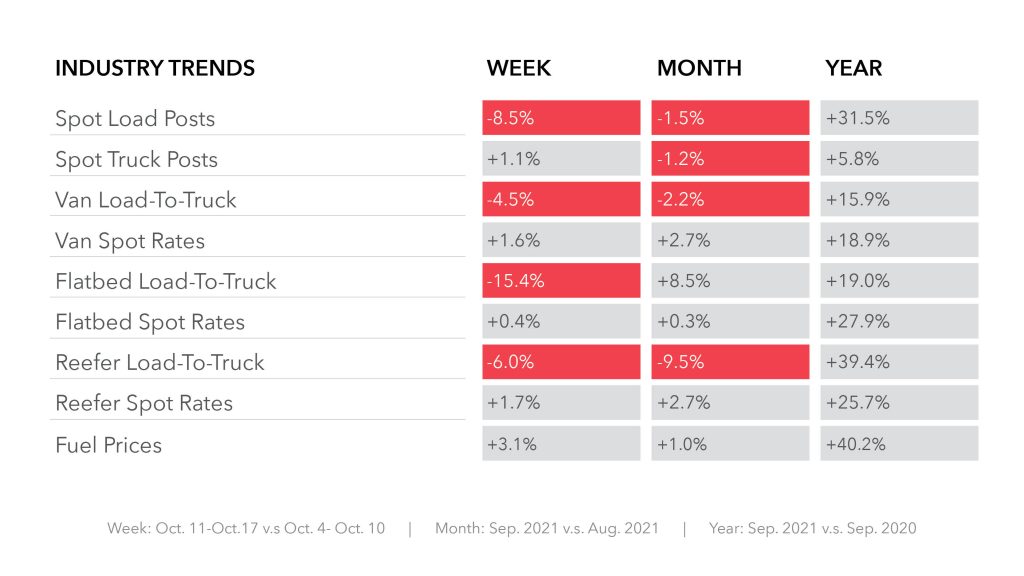

Load-to-Truck Ratio

The load-to-truck ratio is the most accurate measure of supply and demand in the logistics market. The chart below indicates the number of loads available compared to the number of trucks that are in the market, on a comparative percentage basis. The higher the ratio, the more loads there are compared to available trucks. A higher ratio indicates a tighter market, resulting in increased rates. When the load-to-truck ratio is lower, rates decrease.

Spot load posts and spot truck posts give a supply and demand snapshot; as spot load posts increase, volume and demand increase. Furthermore, increases in spot truck posts indicate that capacity is increasing.

September saw a month-over-month decrease in load-to-truck ratios, meaning some rates could decrease in the near future. September’s year-over-year ratios saw a large increase for all three trailer types.

Conclusion

A highly volatile freight market makes forecasting a challenge. While driver supply is returning, retaining labor within all areas of the supply chain remains a challenge. This makes it difficult for inventory to catch up while consumer demand and spending are at an all-time high. Expect rates to remain high through Q4.

FWF continues to provide customers and carriers with reliable and new information to navigate the freight market with in-depth knowledge and data. Visit FWF’s resource center for more information that can improve your insights.