Why FWF Market Insights?

FWF’s market analysis provides up-to-date industry insights, enabling you to navigate a constantly moving logistics and transportation industry. Understanding the fundamentals of how rates are affected and monitoring new trends begins with understanding supply and demand. It is vital for your business planning and market knowledge.

If you want to learn more, check out FWF’s Basic Breakdown of Supply and Demand.

Overview

Consumer demand continued to drive the market, as it did for the entirety of 2021. Extremely high consumer spending coupled with peak shipping season near the holidays led to record high rates and tight capacity. 2021’s supply chain constraints also continued through the end of Q4 and into the beginning of 2022. Although rates and capacity are expected to cool off due to seasonality, this January has been far from normal.

Truckload Rates

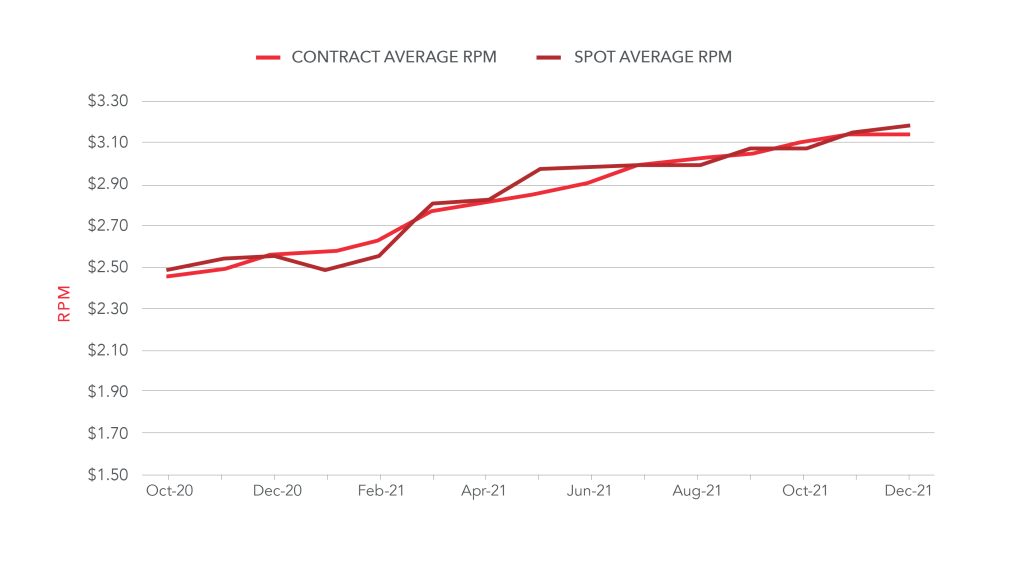

Using spot and contract data from DAT, FWF aggregated the monthly and quarterly rate-per-mile for reefers, flatbeds, and dry vans to determine the average rate-per-mile for the three trailer types combined.

| Quarterly Contract RPM Including Fuel |

Quarterly Spot RPM Including Fuel |

|||||

| Quarter Average | RPM | % Change | Quarter Average | RPM | % Change | |

| Q3 2020 Average | $2.35 | Q3 2020 Average | $2.31 | |||

| Q4 2020 Average | $2.49 | +5.96% | Q4 2020 Average | $2.52 | +9.09% | |

| Q1 2021 Average | $2.65 | +6.04% | Q1 2021 Average | $2.62 | +3.96% | |

| Q2 2021 Average | $2.86 | +7.92% | Q2 2021 Average | $2.93 | +11.83% | |

| Q3 2021 Average | $3.01 | +5.24% | Q3 2021 Average | $3.02 | +3.07% | |

| Q4 2021 Average | $3.13 | +3.99% | Q4 2021 Average | $3.16 | +4.64 | |

You can find the most up-to-date RPM data by trailer type on DAT. Typically, contract rates lag behind spot rates by a few months. This is because contracts are given at the beginning of every quarter or year, and as a result, carriers and shippers look to the spot market to determine fair contract rates.

Continuing 2021’s upward trend in rates, Q4 contract rate-per-mile increased 3.99% from Q3, while spot rate-per-mile increased 4.64%. Several factors contributed to growth in rates, largely related to 2021’s supply chain constraints coupled with consumer demand.

In December, contract rates were up 23.14% Y/Y and spot rates were up 24.71% Y/Y.

The market remains volatile and unpredictable, and rates have held high into the first quarter of 2022. Peak shipping season saw record high rates, with many shippers paying premiums to ensure goods reached consumers in time for the holidays.

Rates typically drop in January, however, 2022 was an exception. On average, spot rates increased $0.11 from December to January and are $0.54 higher than they were in January 2021. As the month comes to a close, linehaul rates have began their typical seasonal downward trend.

Current Driving Factors Contributing to Demand

The pandemic caused an unparalleled boom in consumer demand and spending, with online shopping and social media leading the way. COVID-19 introduced a new norm of spending to all ages and income ranges.

Consumer demand far exceeded supply for all of 2021, especially in Q4 during peak shipping season. With more attention on poor port conditions, many consumers ordered goods far in advance to ensure they arrived on time for the holidays.

Port congestion worsened and many goods did not reach consumers on time as they waited to be unloaded off the west coast. Now, imports that were supposed to reach consumers months ago are just now making their way through the U.S., leaving truck drivers hustling to catch up as capacity remains tight in Q1. While the supply chain catches up, inventory levels will increase and consumer spending will ease, with inflation expected to cause capacity to loosen into 2022.

Driving Factors Contributing to Carrier Supply

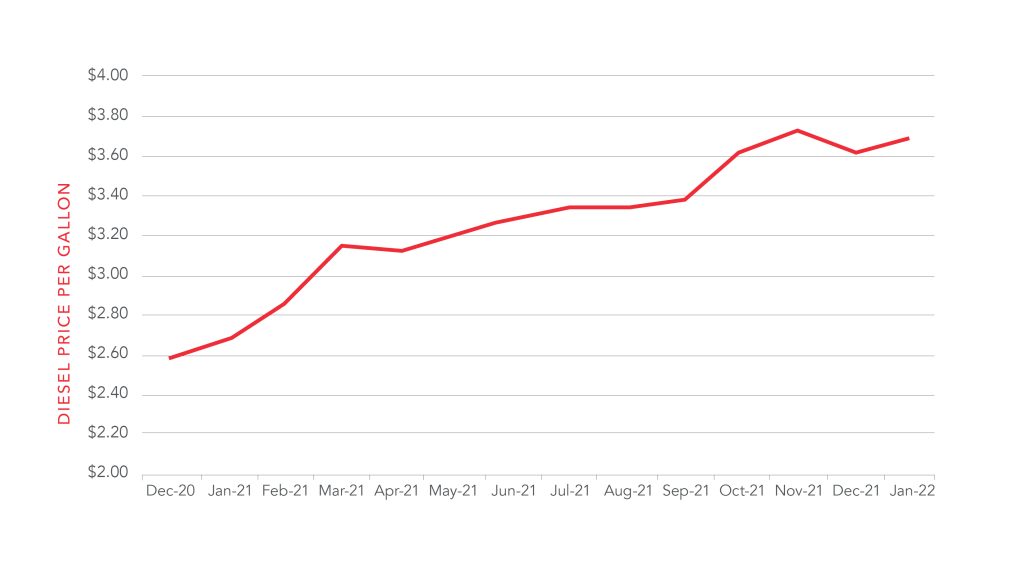

Diesel Prices

Diesel prices are a key factor in determining rates. Before December, the average cost of diesel was steadily increasing, picking up pace in August. This number peaked in November, reaching a national average of $3.73, the highest price in seven years. This prompted the Biden administration to release emergency oil reserves to combat the high costs, leading to relief in December. The $0.11 decrease was related to the COVID-19 omicron variant, which deflated demand significantly.

The relief was short lived as prices began to climb again in January, reaching $3.78, higher than it ever was in November, at a monthly average of $3.69.

Supply Chain Constraints

Port Congestion

Because of the unwavering demand for consumer goods following COVID-19, ports had difficulty keeping up. Port congestion worsened as the fourth quartered continued and the number of vessels waiting to be unloaded reached record highs. Port congestion has been present globally for months, but the holiday season added more strain on this already challenging issue.

According to the Southern California Marine Exchange, 100 container vessels were anchored in the twin ports of Los Angeles and Long Beach, waiting an average of 20 – 27 days to unload at the end of December. It’s estimated that this backlog will last through the first half of 2022.

Labor Shortages

The pandemic has caused a labor shortage throughout all areas of the supply chain, including truck drivers, dockworkers, warehouse employees, and countless others. The American Trucking Association estimated that at the end of 2021, the market would be short over 80,000 drivers, adding to the already tight capacity. In hopes of aiding the shortage, the infrastructure bill, focused on improving the supply chain, opens the door for 18–20-year-olds to become truck drivers.

The cross-border vaccine mandates have also raised concerns for drivers, though the impact on capacity has been minimal thus far. The Canadian mandate prevents unvaccinated or partially vaccinated U.S. drivers from crossing the border, while Canadian drivers will need to quarantine and receive a molecular test before arriving at the border. The U.S. is expected to pass a similar mandate, affecting approximately 20% of drivers.

Microchip Shortage

The microchip shortage persisted through the end of 2021 and is expected to continue throughout 2022. This shortage halts new product from entering a market where they are in high demand. The cost of used Class 8 trucks nearly doubled while new trucks aren’t being produced. According to Freight Waves, Class 8 truck orders in November were the lowest for that month in 26 years. Because of this, experts believe the shortage is due to a massive backlog of unbuilt trucks and low demand.

General Supply and Demand Indicators

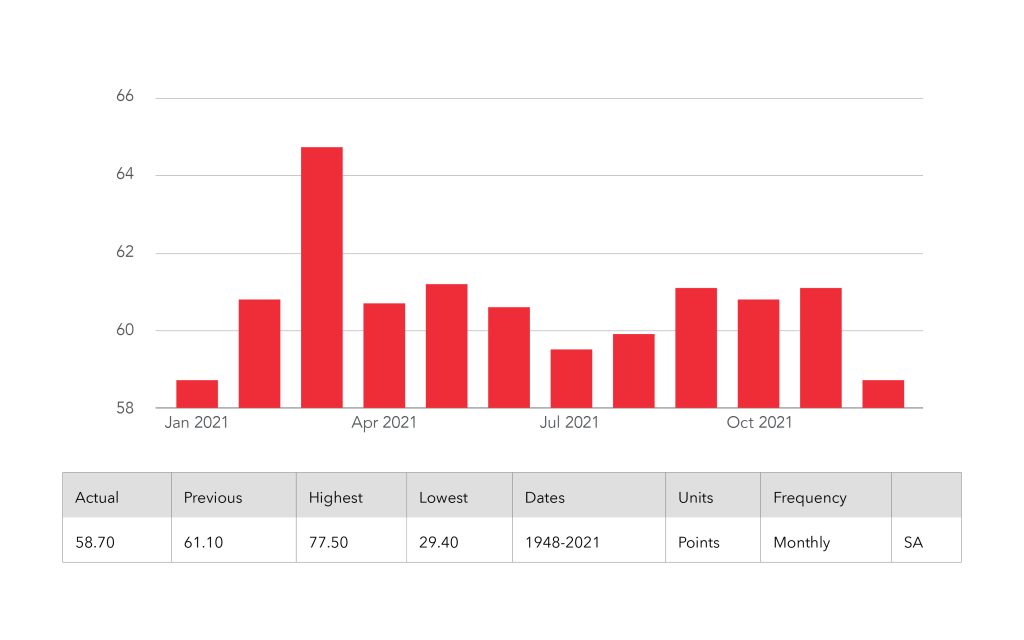

ISM Purchasing Manager’s Index

The Purchasing Manager’s Index (PMI) is a measure of the direction of economic trends in manufacturing. Covering 19 industries, including both upstream and downstream activity, this is a leading indicator of overall economic activity. In the United States, a PMI reading over 50 means the manufacturing economy is expanding, while a reading under 50 means the industry is contracting. When the PMI indicates an expansionary manufacturing economy, volume increases due to increased output.

Currently, the PMI reads 58.70, indicating an expanding manufacturing economy and suggesting a continued increase in shipment volume. This is a decrease from November’s reading of 61.1 and is the lowest reading since January 2021.

Conclusion

Q4 ended an unpredictable year strong and the market has shown no signs of slowing down. The constraints of 2021 have continued into the new year as the supply chain works to catch up. Although inflation has not taken its toll on consumers yet, it is the number one market indicator with consumers controlling the market. When the supply chain recovers, capacity is expected to loosen and rates will follow suit, but that may be well into 2022.

FWF continues to provide customers and carriers with reliable and new information to navigate the freight market with in-depth knowledge and data. Visit FWF’s resource center for more information that can improve your insights.